|

GUESS WORLD ENERGY SITUATION IN 2030’S The pace of the

global economic recovery holds the key to energy prospects for the next

several years, but it will be governments’ responses to the twin challenges

of climate change and energy security that will shape the future of energy

in the longer term. The

level and pattern of energy use worldwide varies markedly across the three scenarios in 2010’s Outlook,

which differ according to assumptions about energy and environmental policies. In the New

Policies Scenario, world primary energy demand is expected around 15,750

Mtoe in 2003, it increases by 36% between 2008 and 2035, or 1.2% per year

on average. This compares

with 2% per year over the previous 27-year period. The scenario assumes

cautious implementation of the policy commitments and plans announced by

countries around the world, including the national pledges to reduce

greenhouse-gas emissions and plans to phase out fossil-fuel subsidies.

|

Reporter:

Do Manh Hao, Student no. 55944006 |

Projected demand growth is slower than in the Current Policies Scenario, in which no change in policies beyond

those already adopted is assumed; demand grows by 1.4% per year over 2008-2035,

world primary energy demand will reach over 16,450 Mtoe in 2030. In the 450

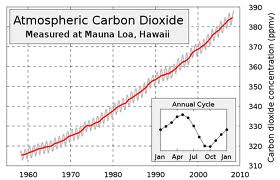

Scenario, which sets out an energy pathway to limit the concentration of

greenhouse gases in the atmosphere to around 450 parts per million of CO2

equivalent consistent with an increase in global temperature of 2°C, but by

only 0.7% per year and the primary energy demand is expected around 14,120 Mtoe.

Save energy to rescure our green planIn the New

Policies Scenario, non-OECD countries account for 93% of the projected

increase in global energy demand, reflecting mainly faster rates of growth of

economic activity. China,

where demand has surged over the past decade, contributes 36% to the projected

growth in global energy use, its demand rising by 75% between 2008 and 2035

(our preliminary data suggest that, although Americans consume more on a

per-capita basis, China overtook the United States in 2009 to become the

world's largest energy user). Aggregate energy demand in OECD countries rises

very slowly. Nonetheless, by 2035, the United States remains the world’s second

largest energy consumer behind China.

Global demand for each fuel source

increases, with fossil fuels - coal, oil and gas - accounting for over 50% of

the increase in total primary energy demand. Rising fossil-fuel prices for end uses, resulting from

upward price pressures in international markets and increasingly onerous carbon

penalties in many countries, together with policies to encourage energy savings

and switching to low carbon energy sources, help to restrain demand growth for

all three fuels.

Oil remains the dominant fuel in the primary

energy mix to 2035.

Nonetheless, its share of the primary fuel mix diminishes as higher oil prices

and government measures to promote fuel efficiency lead to further switching

away from oil in all sectors. Demand for

coal rises through to around 2020 and starts to decline towards the end of the Outlook

period. Natural gas is set to

play a central role in meeting the world’s energy needs for at least the next two-and-a-half

decades. Global natural gas demand, which fell in 2009 with the economic

downturn, is set to resume its long-term upward trajectory from 2010. Natural gas demand increases by 44% between

2008 and 2035 – an average rate of increase of 1.4% per year. Growth in

demand for gas far surpasses that for the other fossil fuels due to its more favorable

environmental and practical attributes, and constraints on how quickly

low-carbon energy technologies can be deployed. China’s gas demand grows

fastest, accounting for more than one-fifth of the increase in global demand to

2035. The Middle East leads the expansion of gas production, its output doubling

by 2035. Over a third of the global increase in gas output comes from

unconventional sources — shale gas, coal bed methane and tight gas — in the

United States and, increasingly, from other regions. A glut in global

gas-supply capacity, which could peak in 2011, will keep the pressure on gas

exporters to move away from oil price indexation, notably in Europe. Unconventional

oil is set to play an increasingly

important role in world oil supply through to 2035, regardless of what

governments do to curb demand. It meets about 10% of world oil demand in all three scenarios by 2035 compared with

less than 3% today. In the New Policies Scenario, output of unconventional

oil in aggregate rises from 2.3 mb/d in 2009 to 9.5 mb/d in 2035. Canadian oil

sands and Venezuelan extra-heavy oil dominate the mix, but coal-to-liquids,

gas-to-liquids and, to a lesser extent, oil shales also make a growing

contribution in the second half of the Outlook period. In the New

Policies Scenario, oil-sands production alone climbs from about 1.3 mb/d in

2009 to 4.2 mb/d in 2035, making an important contribution to the world’s

energy security. The share of nuclear

power increases from 6% in 2008 to 8% in 2035. The use of modern renewable energy — including hydro,

wind, solar, geothermal, modern biomass and marine energy — triples between 2008 and 2035, its

share in total energy demand increasing from 7% to 14%.

Proved reserves of crude oil and NGL on global scale is estimated approximately 1,239 billion barrels, the energy

resource can be exhausted by 2050.

However, reserves of shale oil are quite high at 4.8 trillion barrels. Natural gas was identified appearing on

103 countries in the world with a reserves

approximately 186 trillion barrels, the resources is forecasted be exhausted by 54 years. Coal reserves is about 860 billion tones

in which 405bt of bituminous, 260bt sub-bituminous and 195bt of lignite. It is

abundance and widespread with commercial mining taking place in about 70

countries and expecting to use for 128

years. In 2008, approximately 43,880 tU uranium is produced world-widely

and according to world energy council, it will be exhausted around 2070.

What is the cause of war in Libi ? Energy !

Literature

cited/reference materials

IEA, 2009. World energy outlook 2009.

Lodon, United Kingdom.

IEA, 2010. World energy outlook 2010

factsheet. 75739 Paris Cedex 15, France.

World Energy Council, 2010. 2010 survey

of energy resources. London W1B5LT United Kingdom.

New Energy Foundation. Energy situation. http://www.nef.or.jp/english/new/index.html.

|